- Oct 8, 2025

- 8 min read

Free Printable Monthly Budget Calendar

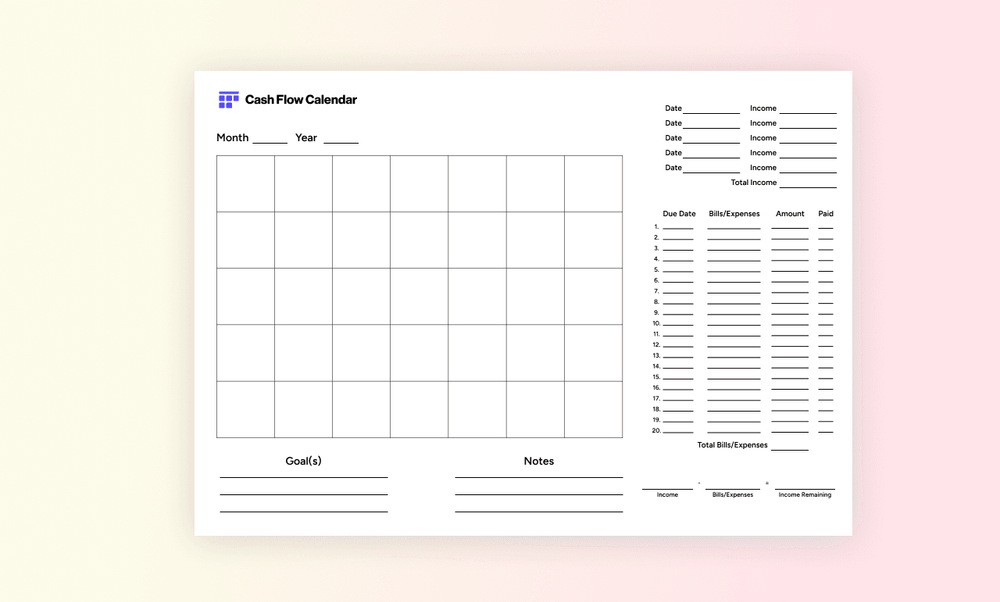

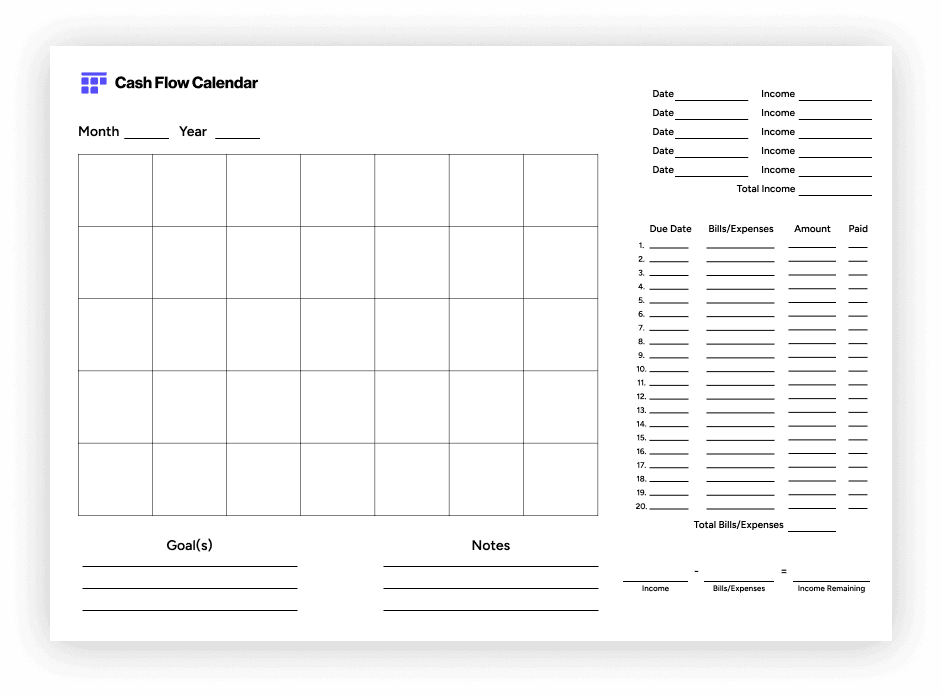

Keeping track of bills, paydays, and savings goals can feel like juggling with your eyes closed — especially when everything hits at once. That’s where a free printable monthly budget calendar comes in. This simple, one-page tool helps you visualize your entire month’s finances at a glance, from income and expenses to financial goals.

Think of it as your monthly budget planner meets printable calendar — minimalist, practical, and actually fun to use.

Plan Your Month and Take Control of Your Finances

If you’ve ever been caught off guard by a bill that’s due two days before payday, you already know why calendar-based budgeting is powerful. Seeing your money flow in real time helps you manage when and where your cash moves.

- With this free printable budget calendar, you can:

- Map out your income and expenses day by day

- Track monthly bills, subscriptions, and savings goals

- Keep everything on one clean, organized sheet

💡 Pro Tip: Print out your calendar and hang it somewhere visible — it’s a daily reminder of your goals and spending habits.

What’s Inside the Free Printable Budget Calendar

This printable template was designed to be both functional and minimalist — no clutter, no distractions. Here’s what’s included:

- Monthly calendar grid: A 5-row layout where you can record bills, paydays, or spending reminders.

- Income tracker: A space to log your income sources by date and amount, perfect for freelancers or anyone with variable pay.

- Bills and expenses list: Up to 20 lines to track due dates, bill names, amounts, and whether they’ve been paid.

- Notes and goals section: Room for jotting down monthly intentions or unexpected expenses.

It’s an all-in-one budget worksheet that doubles as a visual monthly expense tracker.

💡 Pro Tip: Use different colored pens or highlighters to mark categories like bills, income, and savings goals.

How to Use This Printable Budget Calendar

Ready to get started? Here’s how to make this monthly budget template work for you:

- Print the PDF (landscape layout recommended for best fit).

- Fill in the month and year at the top.

- Use the calendar grid to mark bill due dates, paydays, and events that affect your finances (like holidays or travel).

- Log all sources of income in the income tracker — whether it’s your main job, side gig, or a one-time payment.

- Record all regular bills and expenses in the list on the right. Check them off as you pay.

- Add short- and long-term financial goals — like saving for next month’s rent or paying off your credit card balance.

- At the bottom, calculate your total income minus total expenses to see what’s left for savings, debt repayment, or fun money.

💡 Pro Tip: If your bills hit before payday, use the calendar view to plan which expenses to delay or split across pay periods.

Customize and Print Your Monthly Budget Planner

This isn’t a one-size-fits-all worksheet — it’s an editable and printable budget planner that you can tailor to your needs.

- Fill it out digitally (it’s compatible with Excel, Google Sheets, or PDF editors) or print and write by hand.

- Make multiple copies for different bank accounts or family members.

- Print one for each month to create your own DIY budget binder.

👉 Download your Free Printable Budget Calendar (PDF) and start planning next month’s finances today.

Beyond the Printable: Plan Smarter with Digital Tools

While this free budget printable is great for hands-on budgeting, sometimes you want an app that does the math for you.

That’s where tools like Cash Flow Calendar shine. They offer the same calendar-based budgeting concept — but automatically sync your income, bills, and bank account activity. It’s ideal if you love the printable’s simplicity but want more automation and real-time tracking.

Track Savings and Debt for Long-Term Progress

Your printable calendar is just the start. To stay consistent with your personal finance goals, pair it with trackers that help you see progress month over month:

- Savings tracker: Watch your emergency fund or vacation fund grow.

- Debt tracker: Keep tabs on paying down your credit card or loan balances.

- Monthly budget tracker: Compare your planned vs. actual spending.

- Annual budget: Zoom out and see how your entire year looks financially.

Keep each month’s printable in a budget binder — it’s both motivational and practical for reviewing your habits over time.

Tips for Making the Most of Your Free Budget Calendar

Here are a few smart ways to get the most out of your free printable budget calendar:

- Schedule a weekly check-in to mark what’s been paid and update your totals.

- Highlight paydays and high-expense days in different colors.

- Record how much money you saved at the end of the month.

- Print next month’s calendar early to plan ahead.

- Share your setup on social media — it’s motivating and helps you stay accountable.

💡 Pro Tip: Keep a small cash envelope for “fun money” to avoid overspending while keeping your main budget intact.

Download Your Free Budget Calendar (PDF)

This free budget calendar gives you everything you need to visualize your finances, stay organized, and hit your savings goals — without complicated apps or spreadsheets.

👉 Download your Free Printable Budget Calendar (PDF) and start planning next month’s finances today.

Stay Consistent and Watch Your Finances Flourish

Budgeting doesn’t have to feel restrictive — it’s about clarity and control. Whether you stick with the printable or try a digital upgrade like Cash Flow Calendar, the goal is the same: to make your money work for you, one month at a time.

Print, plan, and repeat — your future self (and your bank account) will thank you.

Related Articles

YNAB vs. Cash Flow Calendar: Which Budgeting App Fits You Best?

Oct 8, 2025

Best Calendar Budget Apps in 2025

Oct 8, 2025

Top 7 Budgeting Apps for Freelancers to Manage Finances Efficiently

Aug 18, 2025

YNAB (You Need a Budget) for Freelancers: Is It Worth It?

Aug 19, 2025

Wave vs FreshBooks: Which Invoicing Tool is Best for Freelancers?

Aug 19, 2025

How to Choose the Best Budgeting Tool for Freelancers: A Comprehensive Guide

Aug 19, 2025