Free Printable Monthly Budget Planner

Stay on top of your monthly expenses and financial goals with this minimalist printable budget planner. Download the free PDF or Excel template to plan income, bills, and savings all in one simple monthly calendar.

About This Resource

Take control of your personal finances with our Free Printable Monthly Budget Planner — a clean, editable template designed to make budgeting visual, simple, and stress-free.

Perfect for families, freelancers, and anyone who wants to see exactly how much money comes in and goes out each month.

See Your Month at a Glance

Use this monthly calendar to map every bill, payday, and savings goal. It’s more than a budget worksheet — it’s your month in one place. Track due dates, credit card payments, and subscriptions while keeping an eye on your overall budget plan.

What’s Included

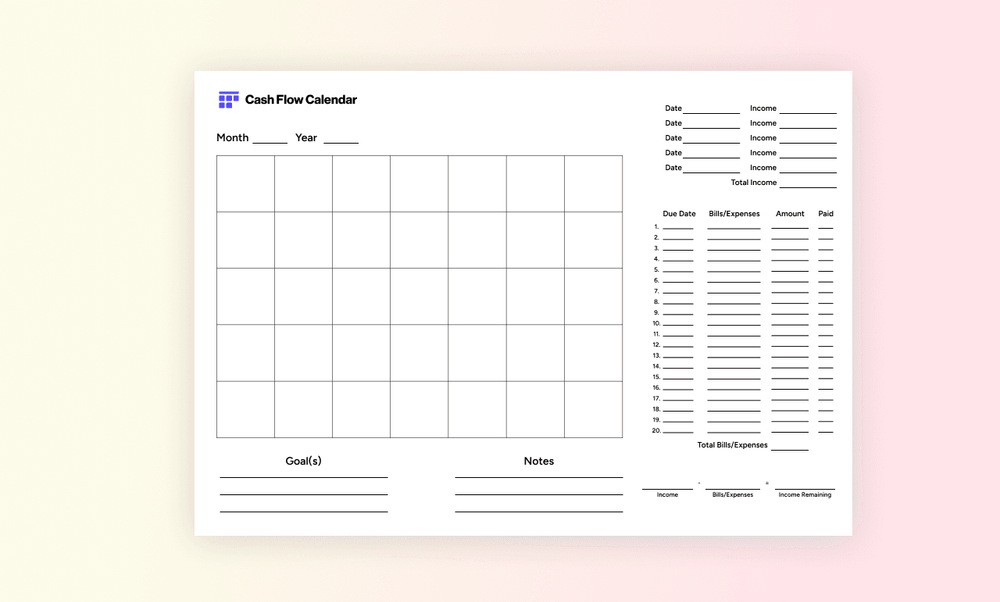

- Monthly Calendar Grid: Plan paydays, bills, and next month’s carry-over.

- Income Tracker: Log deposits to your bank account and calculate total income.

- Bills & Expenses Table: Record monthly expenses with due dates, amounts, and payment status.

- Goal & Notes Section: Define your financial goals and jot down quick reminders.

- Savings & Debt Trackers: Stay accountable with built-in savings tracker, debt tracker, and expense tracker rows.

Why You’ll Love It

- Minimalist and clean layout for focus and clarity

- Fully editable in Excel or Google Sheets

- Print-ready planner template for binder use

- Perfect for personal budget, family finances, or annual budget tracking

- Works seamlessly with budget binders, cash envelope systems, or digital planning

How to Use

1. Start with the Month and Year:

- Write the current month and year at the top so you can easily reference your plan later.

2. Fill in the Monthly Calendar:

- Use the large calendar grid to mark important dates — such as paydays, bill due dates, or savings goals.

- Jot down notes or reminders directly in each day’s box to visualize when money comes in and goes out.

2. Track Your Income

- On the top-right, list every income source (paychecks, side gigs, etc.) with the corresponding date and amount.

- Add them up at the bottom to calculate your Total Income for the month

3. List Your Bills and Expenses

- In the Bills/Expenses section, record each recurring or one-time cost.

- Include the due date, expense name, and amount.

- Use the “Paid” column to check off payments once they’re completed.

- Sum these at the bottom for Total Bills/Expenses.

5. Compare Income vs. Expenses

- At the bottom, subtract your Total Bills/Expenses from your Total Income to find your Income Remaining.

- This helps you see how much money is left for savings, debt repayment, or extra spending.

6. Set Financial Goals

- Use the Goal(s) section to write down 2–3 specific financial goals for the month (e.g., “Pay off credit card,” “Save $200,” or “Track all grocery spending”).

7. Add Notes and Observations

- The Notes section is perfect for reminders, reflections, or adjustments for next month (like recurring subscriptions, upcoming bills, or changes in income).

Printable, Editable, and Ready to Go

This free budget sheet is flexible enough to fit any budgeting style — from minimalist paper planners to digital dashboards. Whether you prefer typing in Excel or using a printable template in your budget binder, it’s built to simplify money management.

Disclaimer

This printable budget planner is for personal finance and educational use only. It does not constitute financial advice. Individual results will vary depending on spending habits and income.